- #Additional paid in capital how to

- #Additional paid in capital full

- #Additional paid in capital plus

For more information please read our full risk warning and disclaimer. This website does not provide investment, financial, legal, tax or accounting advice.

If you are unsure, seek independent financial, legal, tax and/or accounting advice. APIC is also commonly referred to as Contributed Surplus. APIC can be created whenever a company issues new shares and can be reduced when a company repurchases its shares. Investing is not suitable for everyone ensure that you have fully understood the risks and legalities involved. Additional Paid In Capital (APIC) is the value of share capital above its stated par value and is an accounting item under Shareholders’ Equity on the balance sheet. Prices may go down as well as up, prices can fluctuate widely, you may be exposed to currency exchange rate fluctuations and you may lose all of or more than the amount you invest. Trading history presented is less than 5 years old unless otherwise stated and may not suffice as a basis for investment decisions. Past performance is not an indication of future results. When trading in stocks your capital is at risk.

On the balance sheet, APIC is shown separately in the shareholders’ equity section below common stock, with the par value stated near it as reference. Any trading history presented is less than 5 years old unless otherwise stated and may not suffice as a basis for investment decisions. Additional paid-in capital (APIC) is the amount that investors are willing to pay over the par value of the company’s shares.

#Additional paid in capital how to

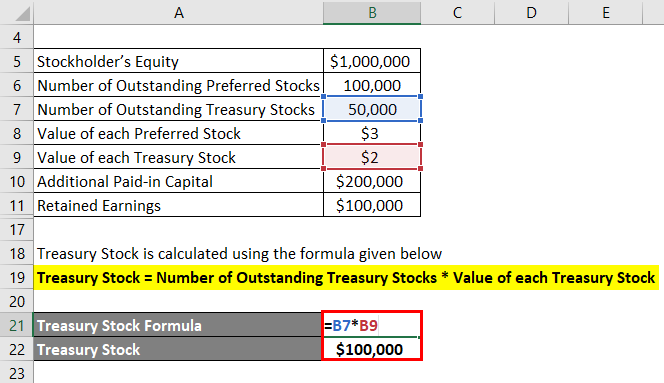

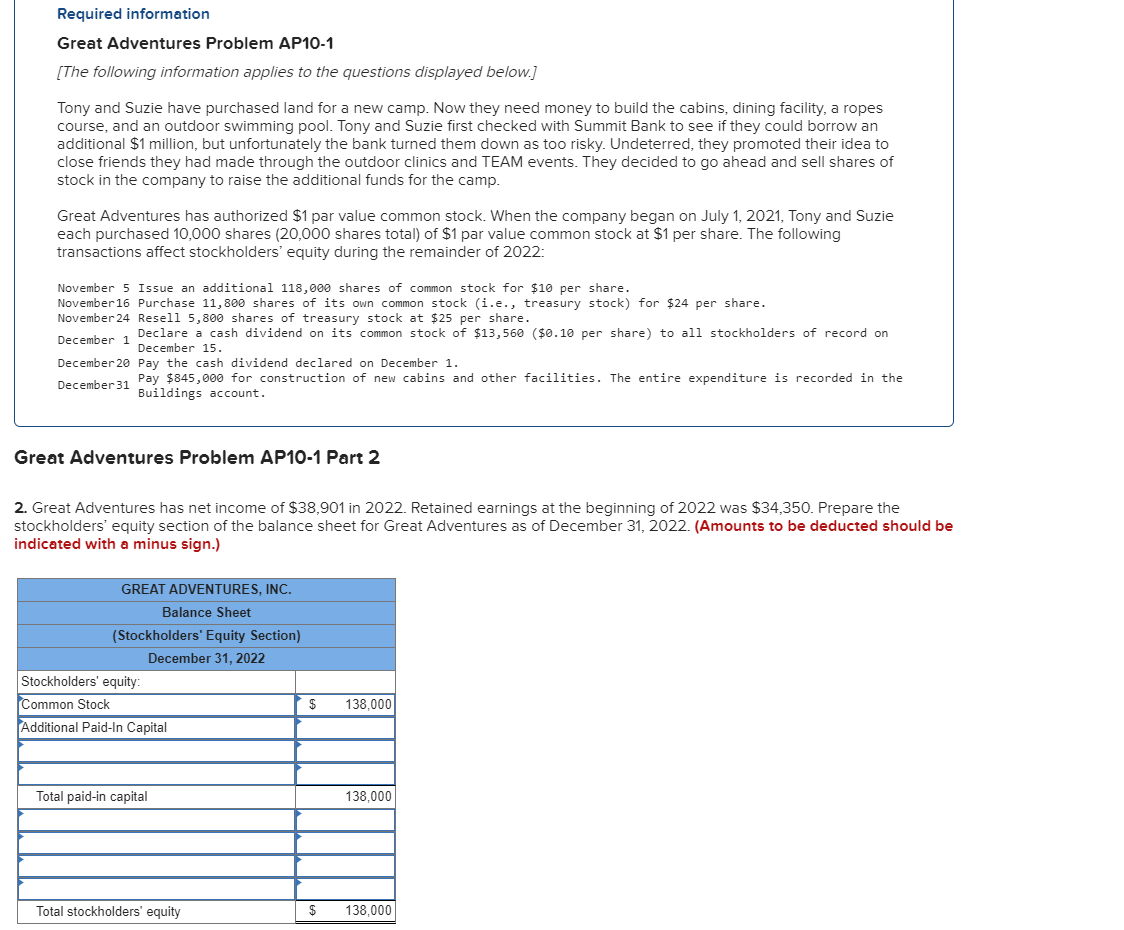

It also illustrates how to compute additional paid-in capital. Past performance does not guarantee future results. This video explains what additional paid-in capital is in the context of financial accounting. This can apply to both common and preferred shares. Trading cryptocurrencies is not supervised by any EU regulatory framework. In accounting terms, additional paid-in capital is the value of a company's shares above the value at which they were issued. Cryptocurrencies can fluctuate widely in prices and are, therefore, not appropriate for all investors. You should consider whether you understand how an investment works and whether you can afford to take the high risk of losing your money. CFDs and other derivatives are complex instruments and come with a high risk of losing money rapidly due to leverage. Each investment is unique and involves unique risks.

contracts for difference (“CFDs”) is speculative and carries a high level of risk. Risk Warning: Investing in digital currencies, stocks, shares and other securities, commodities, currencies and other derivative investment products (e.g. A hyperlink to or positive reference to or review of a broker or exchange should not be understood to be an endorsement of that broker or exchange’s products or services. Notwithstanding any such relationship, no responsibility is accepted for the conduct of any third party nor the content or functionality of their websites or applications. We may receive financial compensation from these third parties. Pour les options de souscription, les sommes perçues lorsque les options sont levées, sont créditées aux postes « capital social » (valeur nominale) et « prime d'émission », nettes des coûts de transaction directement attribuables.Please be aware that some of the links on this site will direct you to the websites of third parties, some of whom are marketing affiliates and/or business partners of this site and/or its owners, operators and affiliates.

#Additional paid in capital plus

On 31 December 2002, the registered capital came to EUR 29,5 billion (corresponding to EUR 4,8 billion of share capital plus EUR 24,7 billion of additional paid-in capital).Īu 31 décembre 2002, le capital souscrit s'élevait à 29,5 milliards d'euros (correspondant à 4,8 milliards d'euros de capital social et 24,7 milliards d'euros de prime d'émission).įor the subscription options, the sums received when the options are exercised are credited to the items "capital stock" (nominal value) and " Additional paid-in capital", net of the directly attributable transaction costs. Primes, titres auto-détenus et autres réserves La différence entre la valeur comptable des actions annulées et leur montant nominal sera imputée sur les postes de réserves ou de primes.Īdditional paid-in capital, treasury shares and other reserves The difference between the carrying amount of the canceled shares and their nominal amount will be allocated to reserve or additional paid-in capital accounts.

0 kommentar(er)

0 kommentar(er)